Duna Ai

Accurate Crypto Tax Analysis. No Guesswork.

1. Connect accounts

2. Review transactions

3. Get tax report

TXA

Built to Support IRS Tax Guidelines

Full support for unique IRS reporting requirements, including U.S.-specific rules around personal use, mining, staking, and airdrops. Ensures compliance with applicable legal frameworks such as the DUNA Act for relevant DAO structures.

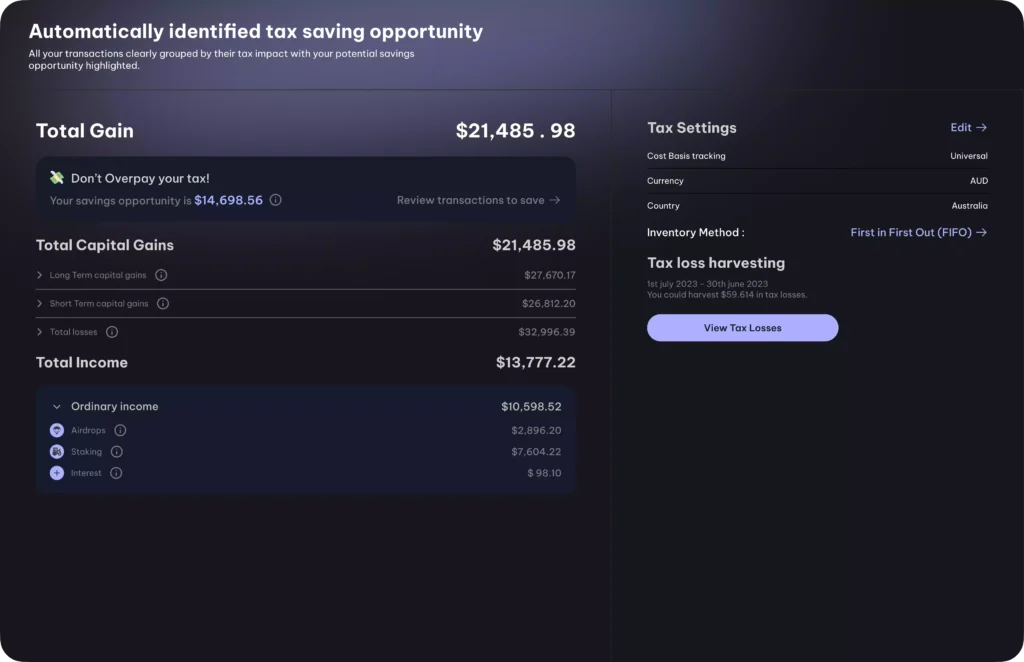

Minimize Tax Liability

Our exclusive “Least Tax First Out” algorithm optimizes your crypto taxes by selecting the asset lot with the highest cost basis during a disposal event, reducing taxable gains.

Be Confident in Your Calculations

Easily view what’s happening across all your wallets and exchanges, empowering you to make the best decisions at all times.

Make Compliance a Breeze

Fully automated from start to finish. Seamlessly import all your transactions, follow the automated workflow, and receive audit-proof tax reports with ease—all while adhering to compliance guidelines like those outlined in the DUNA Act.

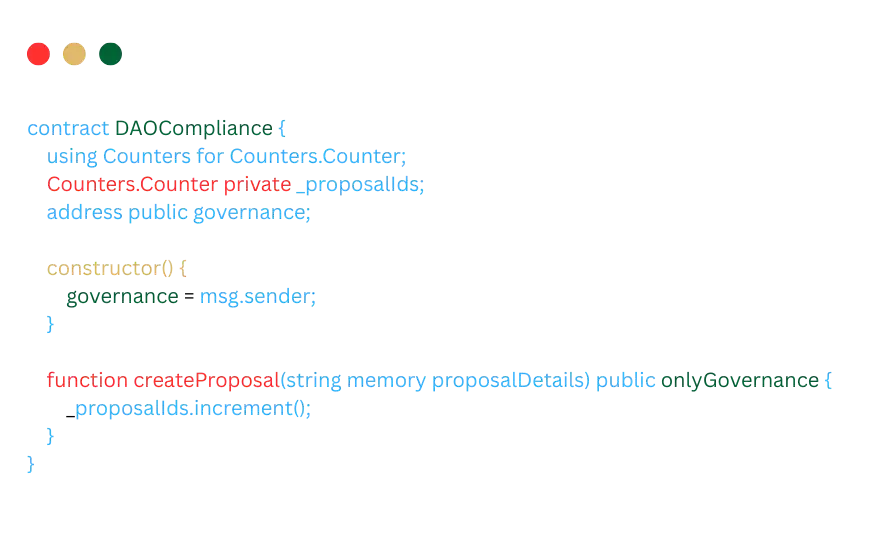

Code in Action

Empowering DeFi and Blockchain

AI-Driven Compliance Automation

Supported by Leading DeFi Protocols

Instant, Real-Time Governance Updates

Smart Contract Executed

DAO Compliance Report Generated

Token Allocation Adjusted

All-in-One Portfolio Tracker

Track your entire portfolio, PnL, and tax liability in one place.

$89,436.20 (6.33%)

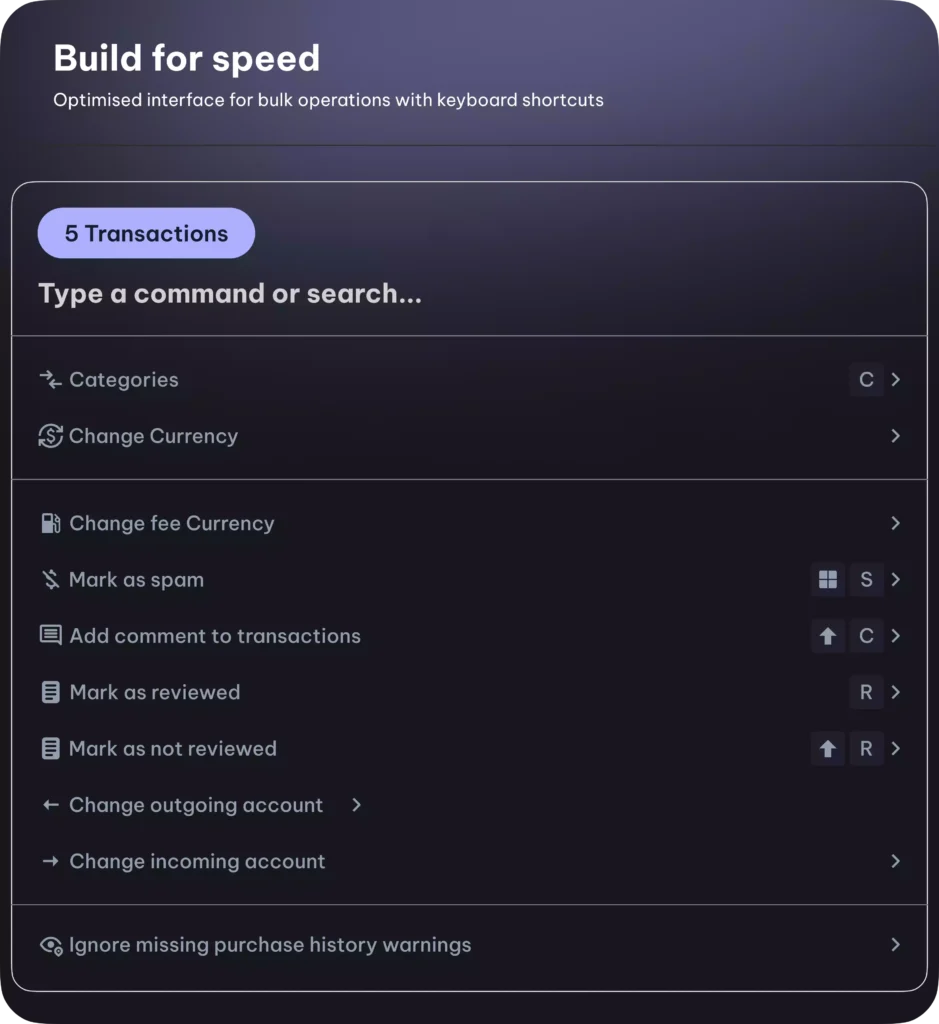

Built for Speed

Automatically Identified Tax Saving Opportunities

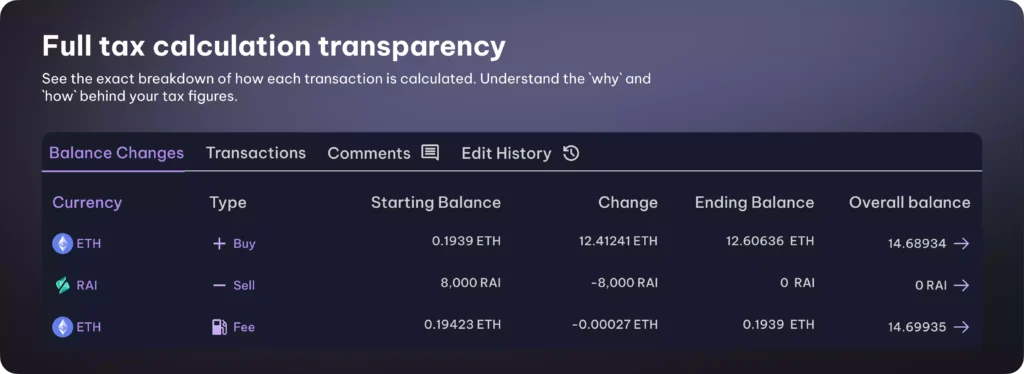

Full Tax Calculation Transparency

See the exact breakdown of how each transaction is calculated. Understand the “why” and “how” behind your tax figures, maintaining transparency and compliance with standards potentially influenced by the DUNA Act.

Frequently Asked Question

Got any questions? We’ve got answers